All Categories

Featured

Table of Contents

With recognized capitalist demands, investors are prevented from investing beyond their methods. If a bad financial investment decision is made, in theory an approved capitalist has higher economic ways to soak up the losses. Moreover, unregistered private safeties might have liquidity constraints; such protections may not have the ability to be cost a time period.

Capitalists must represent their funds honestly to providers of safeties. If an investor states they are a recognized capitalist when they aren't, the economic company can reject to sell safeties to them. Understanding what certifies a financier as certified is crucial for identifying what kinds of safeties you can buy.

First-Class Accredited Investor High Return Investments

The requirements also promote technology and development via added investment. Despite being certified, all financiers still require to perform their due persistance throughout the procedure of investing. 1031 Crowdfunding is a leading actual estate investment system - accredited investor alternative asset investments for alternative investment vehicles mostly readily available to accredited investors. Approved financiers can access our choice of vetted investment opportunities.

With over $1.1 billion in safeties marketed, the administration group at 1031 Crowdfunding has experience with a large range of financial investment frameworks. To access our full offerings, register for a capitalist account.

PeerStreet's objective is to level the playing area and enable individuals to gain access to property financial obligation as a possession course. Due to governing needs, we are required to follow the SEC's plans and allow just accredited financiers on our system. To much better educate our investors about what this indicates and why, read below to learn more about these federal regulations.

Accredited financiers and certified financier systems are watched as more sophisticated, efficient in taking on the danger that some safeties present. This regulation additionally applies to entities, which consist of, banks, partnerships, firms, nonprofits and trusts. PeerStreet is taken into consideration a "private placement" financial investment opportunity, unlike government bonds, and hence based on a little various federal plans.

Exclusive Top Investment Platforms For Accredited Investors

These governing standards have roots that go much back into the evolution of America's banking market. The Securities Act of 1933, only 4 years after the supply market collision of 1929 and in the thick of the Great Anxiety, made particular terms concerning just how safety and securities are marketed.

If you're looking to construct and expand your financial investment profile, consider investments from industrial actual estate to farmland, red wine or great art - accredited investor investment networks. As an accredited financier, you have the possibility to allot a portion of your profile to more speculative asset classes that use diversity and the capacity for high returns

See All 22 Items If you're a recognized financier searching for new opportunities, consider the following varied investment. Yieldstreet focuses on financial investments in realty, legal negotiations, art, economic instruments and delivery vessels. Yieldstreet is one of the very best property spending apps for those thinking about real estate and alternate financial investments that have a high total assets, with offerings for recognized and nonaccredited financiers.

9.6% annualized returns Investment-dependent; arrays from 0.00% for temporary note collection to 2.0%. Masterworks enables capitalists to own fractional shares of art. Masterworks gives you the option to diversify your profile and buy excellent artwork while possibly making make money from 8% to 30% or even more. Art has been a solid historical bush versus stock exchange volatility.

Groundbreaking Accredited Investor Investment Funds

This possibility features all the benefits of other alt investments on the listing, such as diversifying your profile to safeguard against securities market volatility. Vinovest has revealed earnings of 10% to 13% each year in the past. 10.6% annualized returnsAnnual charges start at 2.25% Showed up Houses offers recognized and nonaccredited financiers the choice to deal single-family homeowners and trip rental homes with an ultra-low minimum investment of just $100.

An accredited investor has an unique condition under financial guideline laws. Each nation defines particular needs and policies to certify as a certified capitalist.

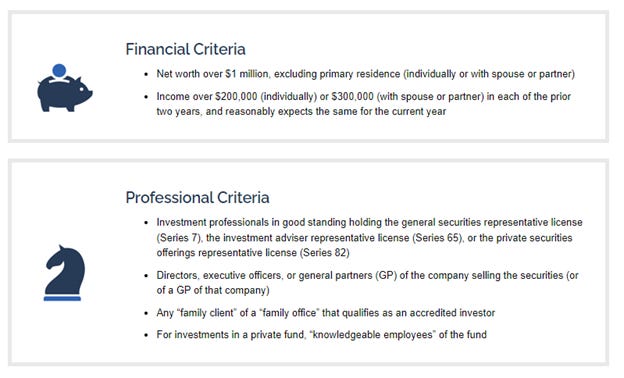

Certified capitalists in the U.S. need to satisfy at least one requirement concerning their web worth or revenue, property dimension, governance standing or expert experience. This requirement includes high-net-worth individuals (HNWIs), brokers, trusts, banks and insurance policy business. The United State Securities and Exchange Payment (SEC) defines the term certified investor under Guideline D.

The concept of assigning certified capitalists is that these individuals are taken into consideration economically sophisticated sufficient to birth the dangers. Sellers of unregistered protections might just market to certified financiers. Non listed securities are inherently riskier since they aren't called for to provide the typical disclosures of SEC enrollment. To become an accredited investor as a private, you have to satisfy earnings or net worth standards, such as an average annual earnings over $200,000 or $300,000 with a spouse or residential partner.

In-Demand Accredited Investor Syndication Deals

The total assets might be combined with a partner or partner. You could also fulfill SEC expert criteria. Discover more on just how to end up being a certified financier here. A variety of financial investment options for recognized investors, from crowdfunding and REITs to tough cash lendings. Below's what you can consider. Crowdfunding is a financial investment possibility growing in appeal in which a business, individual or project looks for to elevate needed capital online.

The function of the syndicator is to scout and protect properties, manage them, and attach financial investment contracts or set investors. This process simplifies property investment while providing certified capitalists excellent financial investment chances. REITs pool and oversee funds bought numerous actual estate buildings or real-estate-related activities such as home loans.

Latest Posts

Tax Sale Foreclosure Properties

How Does Tax Lien Investing Work

Tax Lien Investments